Financial Forecasts using Agent-Based Models

A large UK outsourcing company needed to validate their financial and operational forecasts for a welfare to work programme. The journey of job seekers through the programme could be quite complex. In the most simple case a claimant would be referred to the programme, then be placed in work, and then remain permanently employed. On the other hand, they might only remain in work for a short period, then need to be referred back into the system. This cycle could happen many times in some cases. Understanding this churn was vital - although these complex cases are uncommon, they are disproportionately costly to resolve.

The original excel model that the company had was designed to handle a maximum of 3 possible jobs per person. This gave some indication of the scale of the problem but it wasn’t clear how well this model reflected the long-tail. There could be, for example, extremely costly cases of 8 job placements but it was not clear how common this might be, and what impact that would have on the commercial viability of the programme.

In a simple tabular model, the benefit-claimants are represented statistically - i.e. in aggregate as numbers representing groups of individuals (e.g. a cell might provide a count of people who had been places in two jobs over 18 months). In order to better approximate reality we needed to model the behaviours of each individual.

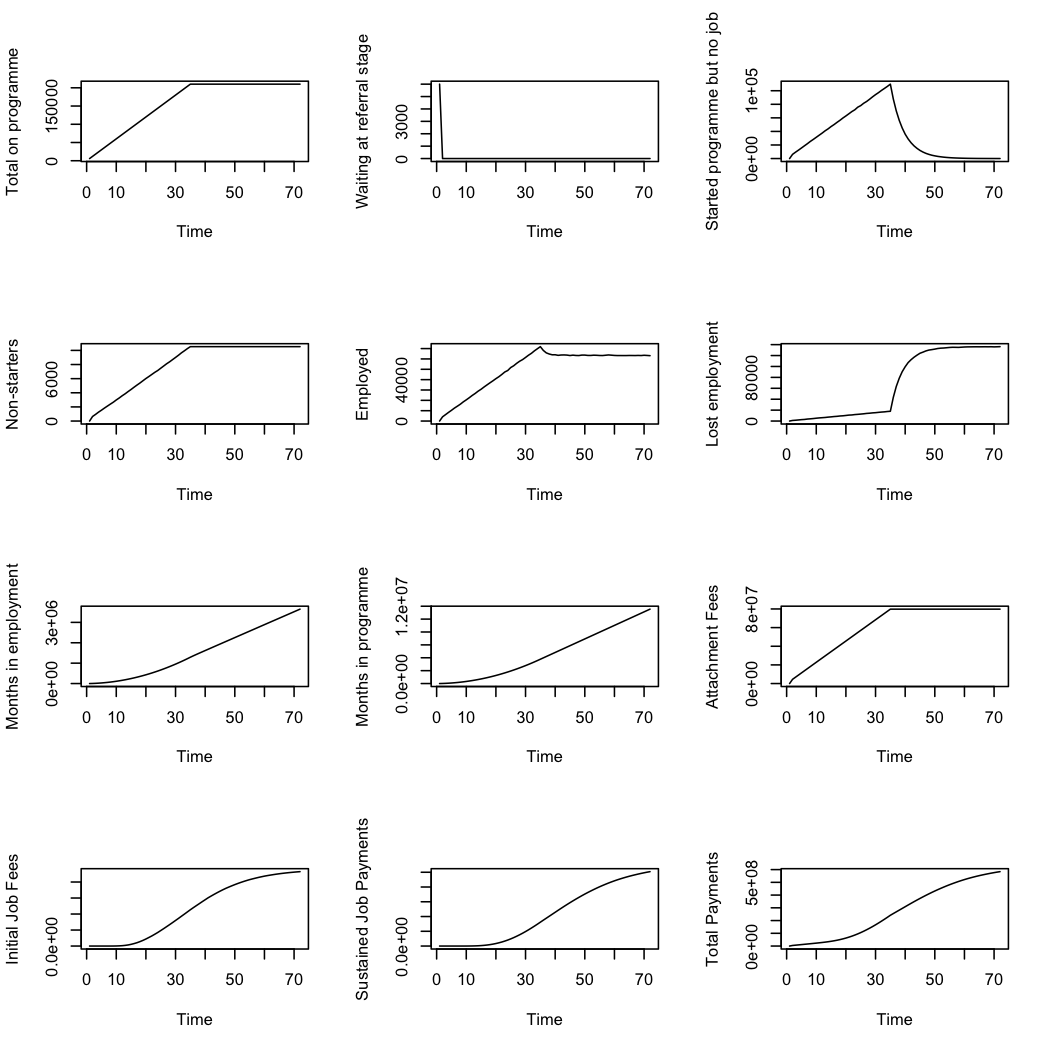

The ecological simulation that we created modelled each benefit-claimant as an agent capable of making their own choices. These agents could potentially cycle in and out of work and infinite number of times. We built the model in GNU-R as it involved many more data points than would be tractable in excel.

In order to understand the flow of people through the system we created visualisations to capture aggregate statistics. These statistics were then compared with those in the original excel model to cross-validate and test it’s conclusions. This provided a better understanding of the implicit assumptions and risks to financial viability.